Alright, so I wanted to talk about my little adventure with what some folks call ‘nets trading’. It sounds kinda fancy, right? Like some secret system. That’s what I thought at first when I decided to dip my toes into the whole online trading pool a while back.

So, I got started like most people probably do. I opened up a couple of brokerage accounts – you know, the popular ones you see ads for everywhere. Then came the fun part: trying to figure out what the heck to actually do. I spent hours, seriously, hours, digging through websites, forums like Reddit, watching endless YouTube videos. Everyone’s got a system, everyone’s an expert.

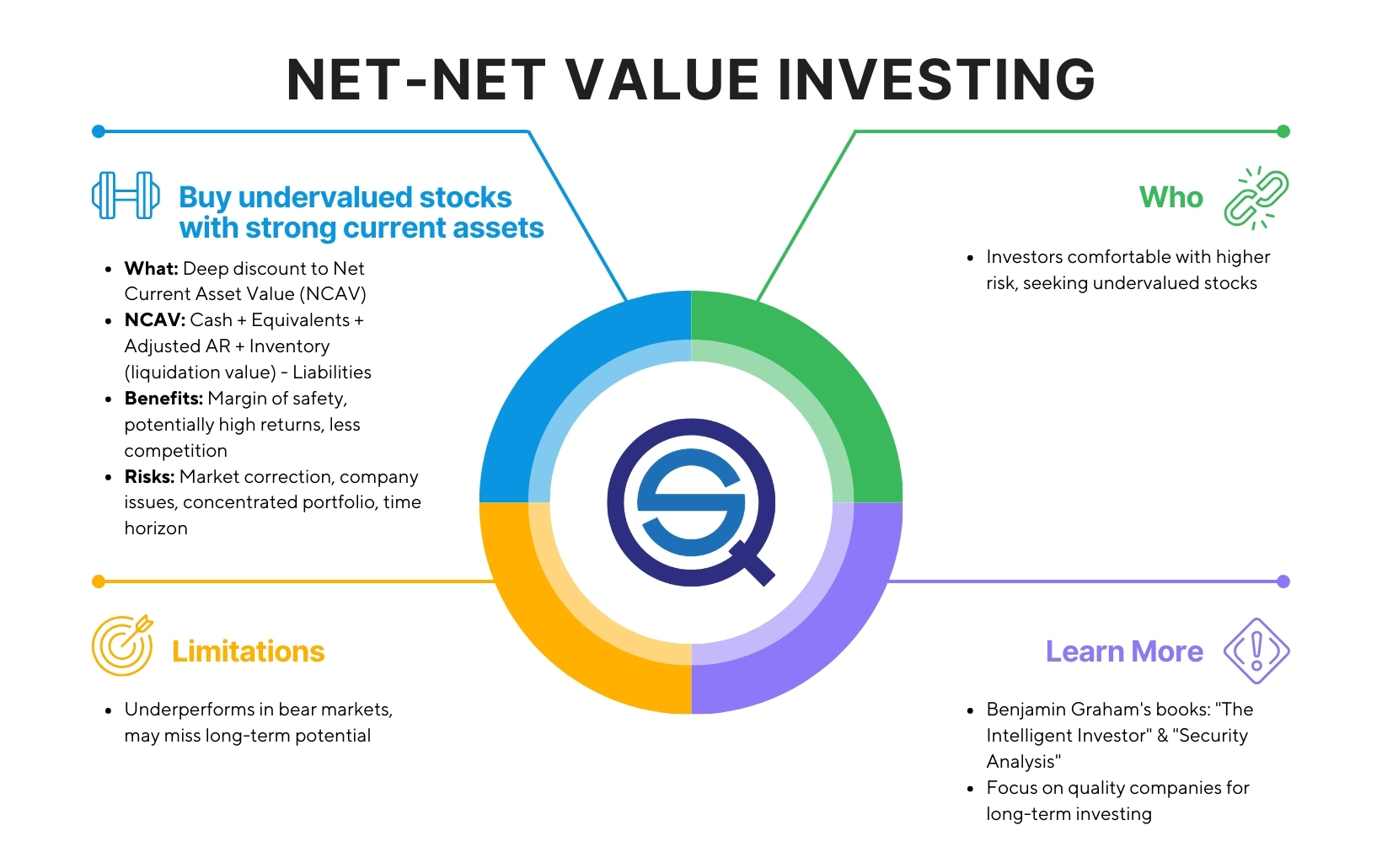

I tried to piece together this ‘nets trading’ idea. Was it about specific stocks? Was it about setting up complicated options plays, like spreads or condors, making a sort of ‘net’ to catch profit? I dabbled in a bit of everything. I tried charting tools, looking for patterns. I tried reading news, trying to guess market moves. I even tried following some ‘gurus’ on social media. It felt like I was building this massive, tangled web of information and strategies in my head.

The Messy Reality

Here’s the thing, though. It got messy. Fast. One strategy would tell me to buy, another based on a different indicator would scream sell. Reading company reports took forever, and honestly, half the time I wasn’t sure what I was looking at. The options stuff? Way more complicated than it looked on paper. Calculating the potential profit and loss, especially when things moved fast, was a headache. It felt like trying to build something complex with a bunch of tools that didn’t quite fit together, you know?

- One guy says only trade trends.

- Another says buy dips.

- Then there’s the options crowd talking about theta decay.

- And don’t forget the macro-economic news!

It wasn’t this clean ‘net’ I imagined. It was more like a big, tangled fishing line snagged on everything. I wasn’t catching profits; I was mostly catching stress. Made some really dumb mistakes early on because I was trying to juggle too many conflicting ideas I barely understood. Lost a bit of cash, which always stings, but mostly I lost time and sleep.

I remember this one period, I was trying to balance this trading stuff with my regular job and family commitments. It was rough. I’d be checking charts on my phone during dinner, sneaking looks at market updates when I should have been focused elsewhere. It started feeling less like an opportunity and more like a burden. I wasn’t sleeping well, constantly thinking about open positions or what the market would do next. I realized I was just chasing my tail, caught in this cycle of information overload and impulsive decisions.

Scaling Back and Moving On

So, what happened? Well, I had to take a step back. I basically stopped trying to do everything at once. Closed down some accounts, unfollowed a bunch of people online. I decided to focus on just one simple approach – something I could actually understand and manage without it taking over my life. It’s way less exciting, I’ll tell you that. No fancy ‘nets’, no complex options structures.

Looking back, ‘nets trading’, or whatever you want to call trying to combine multiple complex strategies, wasn’t some secret sauce. It was just… complicated. Maybe it works for some super-smart, full-time folks, but for me, trying to piece it all together from online tidbits was a recipe for confusion and anxiety. Now, I just stick to the basics. Slow and steady. It’s not glamorous, but at least I can sleep at night.